Background

There are two main levers that an insurance company can use, if needed, to increase the premium and impact performance in an inforce life insurance policy. The first, which is specific to interest-sensitive products like universal life and whole life, are interest and dividend rates.

These crediting rates are much like a savings account, they credit the policy holder with in interest or dividend payment based on their going rate and cash value balance. This rate can and will have a direct impact on the policies longevity and cash value growth.

The rate credited is driven largely by the insurance company’s investment in government bonds, AAA corporate bonds and mortgages. Interest rates have been at historically low rates in all of the instruments above for the past 15 years. In many cases the insurance companies are guaranteeing a rate inside of these policies at 4% or more which is more than they can currently achieve with a new bond portfolio at today’s rates.

This has led to a drop in what companies can offer in new products and a drastic drop in what may have been illustrated on a sale that occurred even 5 or 10 years ago. Most companies older blocks of policies are already at what is called the ‘Guaranteed Rate’ or lowest rate they can contractually offer the policy holder. With Whole Life policies, their divided scale or rate, has also been in a decline for over 20 years, largely due to the interest rate environment.

The second lever is the policy internal charges, which include items, like cost of insurance, administration charges, etc. These charges are included, in some form, with all life insurance policies. The charges have a current basis and guaranteed basis. In other words, the product cannot contractually charge you more than the guaranteed basis, but they do have room to increase the charges beyond the current basis.

This impact can be much more significant than a crediting rate drop and has rarely happened in the life insurance industry. However, once a company has dropped their crediting rate as low as they can, if they are still not profitable they can begin raising their internal charges.

Recent Events

In the past few years many companies have been forced to increase their internal charges. This is a first for many of these companies. The reasons vary, for some it is a direct reflection on the interest rate environment, for others it is a reaction to sales practices allowed by the company in past years.

As of today, specifically, Banner, Lincoln Benefit, ING/VOYA, AXA, Transamerica, Lincoln, John Hancock are some of the companies that have made internal cost modifications. This may not impact all policies issued by these companies and since all of these companies are stock companies, it will likely lead to an INCREASE in their ratings, which may be very misleading.

We expect to see further consolidation in our industry and internal charge increases by additional carriers in the near future due to the current low interest rate environment.

Example

Inforce Insights client with a non-guaranteed (interest sensitive) universal life policy from one of the companies listed above.

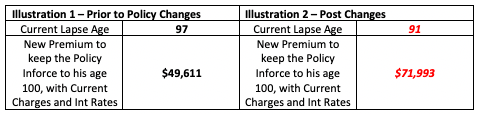

Requested illustration 1, before the rate changes were announced and another on October 15, 2015 after the internal charges had been changed.

The client is an 87 year old male, who purchased this policy in 2003. In the original design the policy he had a $1M death benefit that would stay inforce to his age 100 with a premium of $40,346 per year at current charges and assumed crediting rate.

This is an interesting example because you can see the impact from 2003-2015 on the crediting rate drop which has reduced the client’s policy longevity from 100 to 97, roughly a 12% reduction in coverage longevity from the original purchase. To remedy the situation it would take roughly a 22% increase in premium.

In Contrast, the change to the internal charges has caused a 60% reduction in current policy longevity and will cause an 80% overall increase in premium to put his policy back on track to the original longevity.

Conclusion

The impact of performance inside of interest sensitive universal life and whole life policies is likely to decline over the next 5 years, even if the interest rate environment improves, which post COVID is not likely for until at least 2023. This in not necessarily due to bad products or bad insurance company selection; however, action to save these polices needs to happen sooner rather than later. Any client that has this type of product or one of the carriers above should review a current inforce ledger, especially if those clients intend to keep the coverage and the clients are over 70, as the impact of the rate and charge changes will be more significant. The longer this situation is ignored, the more expensive and difficult it will be to address these issues.

An inforce illustration should be ordered to see what internal modifications can be made, like an increase in premium or reduction in death benefit, to keep the policy inforce.