Participating Whole Life products are often considered to be, except for term insurance, the simplest products to understand. You pay a premium each year and if that premium is paid your base death benefit and cash value are guaranteed by the insurance company. At their core, Whole Life, also known as Traditional Life or Ordinary Life, are great products. They can be used to grow substantial cash value inside of the contract with guaranteed components that can make them very attractive, but they are very rigid contracts that can have some major pitfalls.

The main component in a Participating Whole Life product, that makes it unique, is the dividend. The dividend much like a stock is a payment made by the insurance company to credit your policy. Dividends are not guaranteed by the insurance companies and can fluctuate with interest rates and specific insurance company experience. These dividends can be used in many ways, they can be paid in cash, reduce your premiums, but most commonly they purchase something called paid up additions.

Paid Up Additions (PUA’s) offer additional death benefit and cash value, separate from the base policy. This is important, because PUA cash value can be used or taken from the policy, where the base cash value can only be accessed by loans or surrender.

The complication with these products, typically is how they are sold. Many agents historically, show the dividends and paid-up additions cash value reducing or stopping premiums at some point, 15 or 20 years in the future, commonly called a Vanish. However, dividends as illustrated have not preformed, causing many assumptions made at the time of sale to become obsolete.

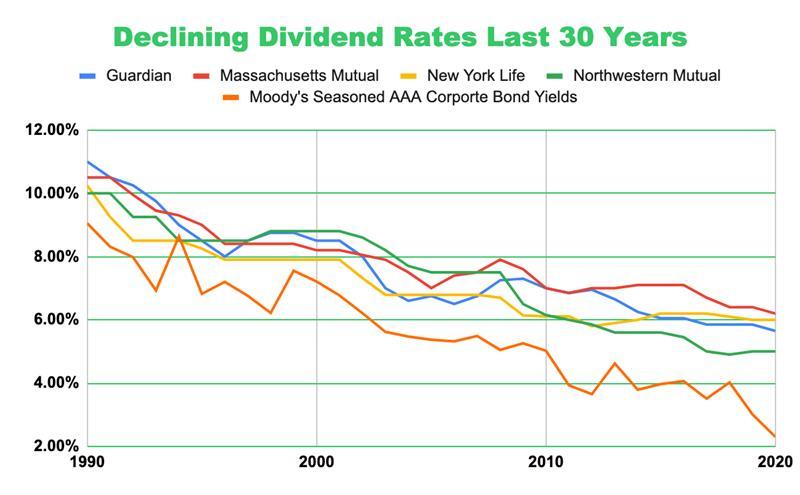

The reductions in dividend payments is not due to bad product or bad insurance companies, much of these reductions are due to low interest rates. That said, when a client or doner must pay an additional 5, 10 or 20 insurance premiums, the reason why the product did not work goes out the window and in many cases those additional premiums are never paid.

The Complications…

Once you have an underfunded Whole Life policy, the policy may still be able to stay inforce. If the dividends will not cover the premium and you run out of PUA cash value, the Whole Life policy will start to use the base cash values via loans. At this point the policy will begin to see death benefit decreases over time, with loans and compounding interest.

There are other concerns, like the non-forfeiture option selection. These are set in case premium payments are not met. As mentioned above these are ridged contracts and premium payments must be paid each year, no matter what, with either out of pocket cash or policy values. You must work with the insurance company to make sure your dividend and non-forfeiture provisions are set up properly or even a well-funded Whole Life Policy will lapse.

Also, there is the issue of blending Whole Life policies, this looks good initially, as the blend will reduce the initial cost of the product. However, generally, it sets up two separate fee structures inside of the policy, which gives the insurance company more leverage to change policy charges, apply dividends, etc. These ‘blended’ products often cause the most frustration.

Whole Life is one of the oldest insurance products, there are many versions and variations. The core issues are generally the same. There are solutions and ways to optimize each situation, but these products, once inforce, cause the most confusion, frustration, and policy service of any product type for our customers. Interest rates and whole life dividends are at historic lows and consumers are now in a 30-year period of declining dividend rates, these problems are only going to get worse (see chart below). Inforce Insights can assist in identifying these optimal issues and actioning solutions based on your situation and needs.